One of the greatest injustices of capitalism in our globalized world has to be hidden credit card fees. How dare we be led to believe we’re snagging a great deal online, only to have the bank statement reflect that our dollars saved was negated by credit card charges? Such wrongs must be righted. Sure enough, in an almost impossible-sounding feat, a new partnership has leaped over that hurdle with a card that could care less about hidden fees.

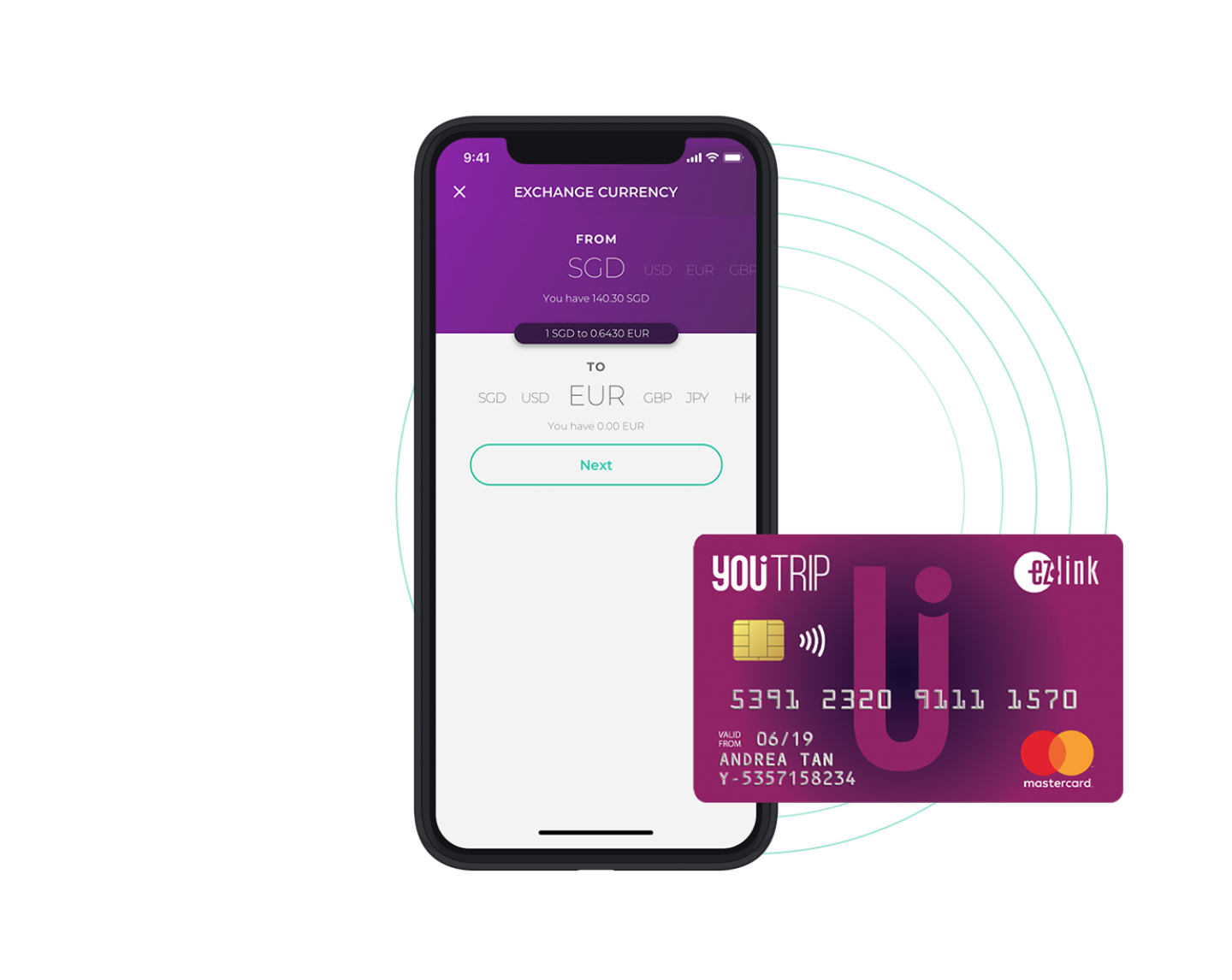

YouTrip is the first multi-currency mobile wallet without any currency conversion or transaction fees—essentially, and literally, the one card to rule them all. A collaboration between EZ-Link, Mastercard, and newly launched You Technologies Group, it lets users pay in more than 150 currencies when overseas or shopping online.

There is a physical card—a contactless Mastercard prepaid card—but all of the magic happens online. Once you sign up, you’ll be issued a card with the same unique 16-digit pan number and CVV code as any debit or credit card. This is linked to your mobile app account; once you make a purchase online or abroad, payment goes through as usual, but without the pesky 2.8% admin fees typically charged by banks in a foreign currency transaction. The catch is you have to be shopping at a Mastercard merchant—but then there are 30 million worldwide, so you’re good.

You can even store up to 10 selected currencies (SGD, HKD, JPY, AUD, NZD, EUR, GBP, CHF, USD and SEK) in your wallet at any one time, for if you want to change money in advance when a rate is good. No more lining up at decrepit currency changers in heartland malls at the last minute.

The best part: if you’re returning from a holiday with some extra foreign dough, you can convert and use that leftover money in any of the 150 currencies back in Singapore or elsewhere. The app automatically converts leftover currencies at wholesale exchange rates with no additional fees. This means if you were placing an order in USD online but didn’t have enough USD in your YouTrip wallet, the app helps you top up the balance directly with whatever currencies you do have—kind of like how DBS PayLah draws straight from your bank account when you have insufficient balance for a transaction.

Sign-ups and top-ups are free with no minimum account balance, and each account can store up to $3000. If you lose the card, you can deactivate it immediately. YouTrip is currently fresh out of stock with a long waiting list, but stay on your toes; representatives from the company have said that a new batch will launch sometime next week. It’s the travel and shopping godsend we’ve been waiting for.

YouTrip is available for download from the App Store or Google Play.